MINERVA-The World’s first reverse merchant processor

MINERVA-The World’s first reverse merchant processor

Minerva is a

platform built on the Ethereum blockchain and its cryptocurrency is the

OWL ERC20 token. The aim of Minerva is to address mainstream

cryptocurrency adoption issues and provide partnered businesses with

incentivized payment solutions.

MINERVA DIFFERENT FROM BITCOIN

The

core differences between Minerva and Bitcoin is that Minerva is

designed to reward platforms that accept its OWL token with reverse

transaction fees, as well as address the challenges of mainstream

cryptocurrency adoption. Minerva is a platform and its OWL token is its

currency. In addition to being a cryptocurrency, we are the world’s

first reverse merchant processor.

MINERVA BE USED

Minerva

will be used on carefully selected platforms which are subjected to

rigorous auditing and transparency agreements. It is unlikely will

consider parterning with any platform with a > 15,000 Alexa ranking.

USE MINERVA TOKENS

ERC20 compatible wallets such as MetaMask, MyEtherWallet or TREZOR (with firmware >= 1.5.2 due to a recent security issue) for a physical cold storage solution.website

ERC20 compatible wallets such as MetaMask, MyEtherWallet or TREZOR (with firmware >= 1.5.2 due to a recent security issue) for a physical cold storage solution.website

TOKEN CROWDSALE

As

displayed in the pie chart above, the token crowdsale is divided

between multiple factions. 70% of the tokens will be distributed amongst

crowdsale participants. 10% will be distributed amongst the founding

team and advisors. 10% will be reserved for long-term operational costs

and new advancements. 5% will be reserved to be distributed to new

partnerships in the form of signing bonuses. The remaining 5% will be

reserved for and split between our promotional bounty and diligent bug

bounty programs. All value transferred in exchange for OWL tokens during

the crowdsale is the revenue of Minerva Technologies S.a.r.l.

MINERVA ADVANTAGE

New

cryptocurrencies are introduced almost daily and their values can grow

exponentially from inception. At the same time, many are abandoned after

their novelty and market “honeymoon period,” thereafter quickly falling

out of meaningful use. Despite these nascent cryptocurrency market

features, it is clear that several statistical properties of the

cryptocurrency market have been stable for years. The number of active

cryptocurrencies, the market share distribution, and the turnover of

cryptocurrencies remain fairly predictable.

SPECIFICATIONS

TECHNOLOGY

Minerva

is presently an ERC20 token and smart contract system built on the

Ethereum blockchain. Following this standard, Minerva tokens are easily

transferable between customers and approved merchants using

ERC20-compatible wallets, and can be smoothly integrated into exchanges.

SERVICE AND APPLICATION LAYER

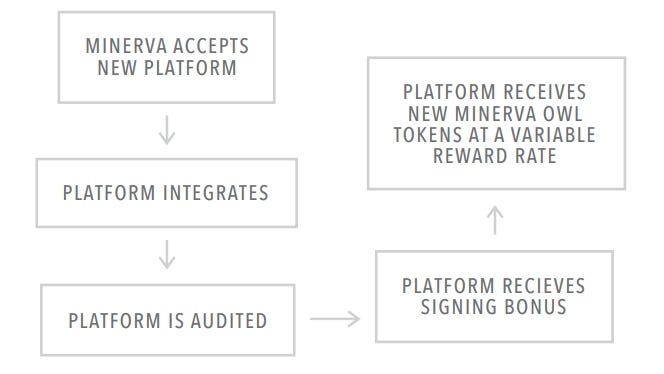

Certain

OWL tokens will be held and issued to approved merchants to serve as

“signing bonuses” subjected to a slow-time-release algorithm and

distributed on a first-come, first-served basis at a variable percentage

of the bonus vault until a point where the vault becomes nearly

exhausted and a signing bonus is fiscally inconsequential.

This is in addition to bonus Minerva OWL tokens issued to approved

merchants via Proof-of-Transaction at a variable rate designed to ease

inflation and combat violent price swings. With this model, OWL tokens

can be exchanged for services on integrated platforms and released back

into the market by approved merchants, thereby creating the added

monetary value. Excluding the initial token distribution event, OWL

tokens cannot be generated by any other method.

This

fundamental revenue-generating aspect of Minerva allows approved

merchants to increase their revenue immediately upon implementation, and

grants more flexibility to these merchants to reward their customers

with discounts.

CRYPTOGRAPHIC AUDIT

The

Minerva team commits to subjecting its platform to comprehensive

security audits. We will implement multiple strategies to provide

maximum transparency in our funds management. The goal is to prove the

following:

1. All profits are properly recorded.

2. The company is in possession of all declared funds.

2. The company is in possession of all declared funds.

For

each platform that accepts the Minerva OWL as a payment method, we will

create a view-only API key which will allow anyone to verify the

balance and trade history of its account. To prevent abuse, monitoring

and resource tracking will limit users from the exploitation of reward

rate loops.

INTEGRATION

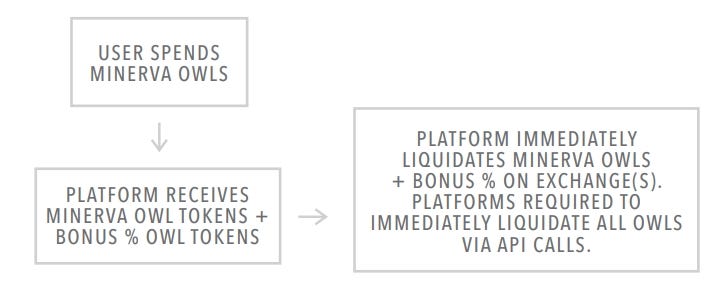

PLATFORM INCENTIVES

Minerva

provides a generous reward system for businesses that accept it as

payment. Upon receiving Minerva OWL tokens, each business is issued a

bonus that resembles a credit card’s “cash back” incentive. When Minerva

OWL tokens are received from their customers, they are automatically

liquidated.

1. Instant liquidity via API from Minerva-relevant trading exchanges

2. The elimination of chargebacks and exchange fees

3. Additional protection from violent short-term price fluctuation

4. Reverse transaction fees. We pay them, not the other way around

2. The elimination of chargebacks and exchange fees

3. Additional protection from violent short-term price fluctuation

4. Reverse transaction fees. We pay them, not the other way around

RISK MITIGATION

The

founder of Ethereum, Vitalik Buterin, has said, “There would then be

multiple separate classes of cryptoassets: stable assets for trading,

speculative assets for investment, and Bitcoin itself may well serve as a

unique Schelling point for a universal fallback asset, similar to the

current and historical functioning of gold.” While Bitcoin itself is not

the unique Schelling point, our aim is for OWL to become a

comparatively stable cryptocurrency which allows businesses to benefit

by simply accepting it as a method of payment. The reward system is

designed so OWL tokens enter the economy at variable rates, making

efforts

to ensure that demand does not cause short-term violent price swings. As is evident below with our first and immediate use case, we will be integrating with a large company at launch, and future businesses requesting integration will require vetting through a rigorous security-focused protocol. Speculation, exchange scams, drug markets and the common negative publicity of cryptocurrencies will all have little-to-no impact on our partnered platforms. Minerva tokens have utility beyond speculative value as they represent an applicable purpose of value between platforms and customers, as well as agents, contractors, vendors, content creators and more.

to ensure that demand does not cause short-term violent price swings. As is evident below with our first and immediate use case, we will be integrating with a large company at launch, and future businesses requesting integration will require vetting through a rigorous security-focused protocol. Speculation, exchange scams, drug markets and the common negative publicity of cryptocurrencies will all have little-to-no impact on our partnered platforms. Minerva tokens have utility beyond speculative value as they represent an applicable purpose of value between platforms and customers, as well as agents, contractors, vendors, content creators and more.

USER BENEFITS

When

customers pay using Minerva’s OWL token, approved merchants have more

flexibility to offer them discounts. This is because, rather than paying

transaction fees, Approved merchants can be paid bonus OWL tokens at

the time of each approved transaction. Users are able to purchase OWL

tokens from any exchange or market where they are traded, transfer them

to one of many ERC20-compatible wallets and spend them on

Minerva-integrated platforms.

CONCLUSION

Minerva

is a platform and its token is designed to be used as a currency;

employing methods to influence the supply of the OWL token, we aim to

combat extreme short-term price swings that plague other

cryptocurrencies. We employ a smart money cycle powered by real economic

activity and business incentives. A positive feedback loop occurs that

expands the Minerva market: The more incentives we provide for

businesses to accept the Minerva OWL, the more purchases will occur. The

more purchases that occur, the less impact speculation will have on

Minerva’s market price. The less impact speculation has, the more stable

the

market price will be. The more stable the market price, the more purchases occur. If the value of the OWL token increases, more incentives are provided to businesses to accept it as payment, therefore increasing the supply and stabilizing the market price. If the value of the Minerva OWL decreases, more incentives are provided to freeze Minerva OWLs in the MVP contract, effectively decreasing the supply and stabilizing the market price. In our quest to stabilize the Minerva OWL we have spent considerable time ensuring that our volatility model is both viable as well as the most optimal decentralized cryptocurrency stabilization solution to date (outside of fiat tethering, a system reliant on cash reserves that presents non-trivial risks of frozen assets via the direct and indirect affiliations to traditional bank accounts). Additionally, fiat tethering prohibits cryptocurrencies from appreciating or depreciating in value in a volatility-tolerable manner and is limited in its flexibility and application in comparison to Minerva. As an endeavor in “smart money” and “reverse merchant processing,” we assert no claims regarding any

initial high volatility in market behavior or outcomes for an unspecified period of time as Minerva becomes institutionalized through community participation, platform integration, and the utilization of MVP (Minerva Volatility Protocol).

Market simulations aside, we use real-world field testing to produce critical data with our immediate largescale use case. We expect to encounter challenges, and we expect to overcome them. We will continue to work with accredited economists, mathematicians and programmers with the goal of producing the most optimal Minerva-compatible stabilization model achievable.Though concerted time and effort will be needed, it is a realistic expectation that Minerva and its OWL token will become one of the most enterprise-friendly platforms and cryptocurrencies available.

market price will be. The more stable the market price, the more purchases occur. If the value of the OWL token increases, more incentives are provided to businesses to accept it as payment, therefore increasing the supply and stabilizing the market price. If the value of the Minerva OWL decreases, more incentives are provided to freeze Minerva OWLs in the MVP contract, effectively decreasing the supply and stabilizing the market price. In our quest to stabilize the Minerva OWL we have spent considerable time ensuring that our volatility model is both viable as well as the most optimal decentralized cryptocurrency stabilization solution to date (outside of fiat tethering, a system reliant on cash reserves that presents non-trivial risks of frozen assets via the direct and indirect affiliations to traditional bank accounts). Additionally, fiat tethering prohibits cryptocurrencies from appreciating or depreciating in value in a volatility-tolerable manner and is limited in its flexibility and application in comparison to Minerva. As an endeavor in “smart money” and “reverse merchant processing,” we assert no claims regarding any

initial high volatility in market behavior or outcomes for an unspecified period of time as Minerva becomes institutionalized through community participation, platform integration, and the utilization of MVP (Minerva Volatility Protocol).

Market simulations aside, we use real-world field testing to produce critical data with our immediate largescale use case. We expect to encounter challenges, and we expect to overcome them. We will continue to work with accredited economists, mathematicians and programmers with the goal of producing the most optimal Minerva-compatible stabilization model achievable.Though concerted time and effort will be needed, it is a realistic expectation that Minerva and its OWL token will become one of the most enterprise-friendly platforms and cryptocurrencies available.

FOR MORE DETAIL :

Website : https://minerva.com/

Whitepaper : https://minerva.com/whitepaper.pdf

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1299271

Komentar

Posting Komentar